Benefits and Challenges of Security Tokens Offering

In this article we will take a look at what a Security Token Offering is and how it works.

Everyone is used to something new popping up in the cryptocurrency niche from time to time, then gaining traction and eventually bursting like a bubble.

That's what happened with Initial Coin Offerings (ICOs), which became popular at the speed of light and turned out to be scams in many cases. Decentralised Finance (DeFi) invented later and are also experiencing a market correction.

On the contrary, Security Token Offerings (STOs) are flourishing during the global COVID-19 crisis.

Experts see tokenisation as a problem solver for many industries - financial aid distribution, fraud prevention, value chain disruption, and investment.

Let us take a look at what a Security Token Offering is and how it works.

What are Security Tokens Offerings?

Security Token Offerings (STOs) combine blockchain technology with the requirements of regulated securities markets to support asset liquidity and wider availability of funds.

STOs are typically the issuance of digital tokens in a blockchain environment in the form of regulated securities.

In layman's terms, STOs fall somewhere between digital assets and traditional financial products.

Digital public offerings perfectly combine the benefits of distributed ledger technology (DLT) and the transparency of physical securities.

A token represents ownership of an asset or an equity or debt security of the issuer. Due diligence terms and disclosure requirements depend on the location and jurisdiction of listing. Certain terms of the token would be encoded in the token.

The Typical Process of STO Creation

- The issuing company finds a securities token lawyer and blockchain companies to guarantee and set up the token structure.

- The blockchain system for issuing securities is identified.

- The characteristics of the token and the underlying asset are specialised to create a smart contract.

- The company contacts third parties such as brokers/dealers, banks, transfer agents, issuers, and auditors.

- The actual fundraising campaign is launched.

- The company advertises the STO fundraising campaign through the trading platform.

- The issuer collects money from the investors and distributes the tokens to the investors with the help of the brokers.

- The issued tokens are sold to a special purpose vehicle ("SPV") and reissued on the trading platform.

Benefits of Security Tokens

Securitised token offerings are a logical outgrowth of ICOs. These new instruments solve most of the problems that ICOs pose.

But what's so good about the Security Token Blockchain for issuers, investors, and the entire ecosystem?

National regulation, increased liquidity and safe record keeping

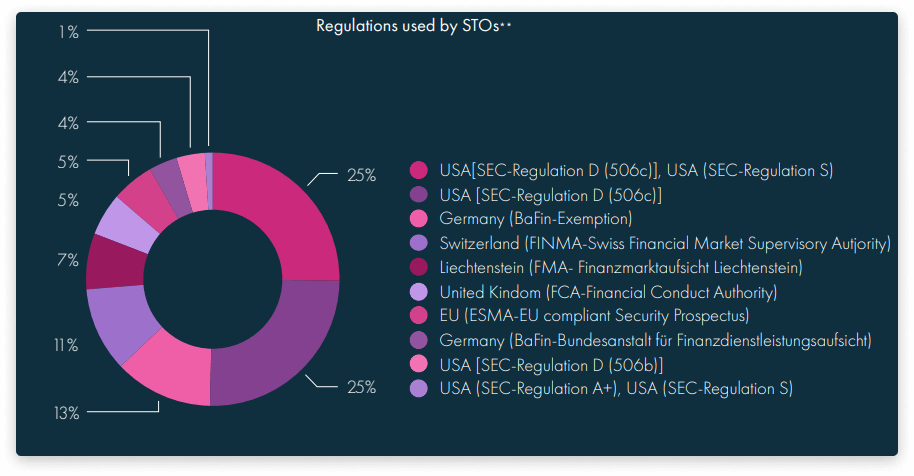

The beauty of security token offerings is that they are legal in many countries/regions and are subject to specific national regulation for activities involving securities.

This particular type of token allows asset owners to monetise illiquid assets such as shares of private companies, real estate or intellectual property rights at a lower cost.

Traditionally, these types of assets are illiquid and should often be traded through an auction or broker.

Without digitisation, it is almost impossible to divide ownership among different investors and arrange buy-sell transactions.

It can also be difficult to standardise asset specifications and present them in a consistent form. Finally, the cost of the asset can be astronomical, such as the price of artwork. With STOs it is possible to easily break the asset into smaller tradable fractions.

DLT allows issuers to record all ownership information (past ownership, transactions, issues) transparently and securely. On the one hand, it helps regulators to resolve conflicts. On the other hand, it eliminates fraud risks.

Further benefits for issuers

- No need for expensive third parties.

- Automatic compliance.

- Asset interoperability.

- Full-time access to markets.

- Quicker deal closure.

- Wider audience of investors.

Great alternative to utility tokens, portfolio diversification and investor protection

Unlike utility tokens, which are popular in ICOs and give investors access to the product/service, security tokens are considered a true financial asset.

Regulators require issuers to disclose their financial data, provide the specification and valuation report of the asset embedded in the smart asset, and guarantee compensation to backers in case of project failure or fraud.

In addition, smart contracts offer more opportunities for diversification, especially through the aforementioned fractional ownership.

Traditionally, backers invest in assets by buying stocks or bonds. STO currency campaigns offer an alternative way to diversify portfolios, invest, trade, and even hedge.

The SEC, FCA and other regulators are very concerned about investor protection. As a result, many asset token offerings are only available to accredited backers who are well versed in investment risks.

In addition, STOs tend to focus on projects in early stages of development where there is an exit option, which provides some investor protection.

Other benefits for backers

- Complete overview of the real value of assets.

- More liquidity for financial instruments.

- No manipulation by issuers and financial authorities.

Challenges of STOs

What are the features of digital public offerings that may deter players?

Lack of financial literacy

The lack of knowledge and clear understanding of security token blockchain discourages people and businesses from entering the field. There are now a variety of terms that are often used interchangeably and without clear definition. Even the term "crypto asset" does not have a specific definition. Explaining the basics of cryptocurrencies and tokenisation should be a priority for a platform.

Gaps in regulation

Although we just mentioned that the beauty of STOs is the legal framework, but there are still unregulated activities.

P2P exchanges and decentralised exchanges remain a shady niche where backers can suffer significant risks and losses. Also, only some governments have developed a solid base of laws and rules for STO activities. Among the best countries for STO adoption are: Estonia, Lithuania, Malta, Canada, the US and Switzerland.

Additional costs and liabilities

Despite the reduction in administrative costs, the introduction of STOs often involves bureaucracy which inevitably leads to statutory charges for other services.

Hiring external professionals is essential as they guarantee the smooth launch of the project. In this case, asset token offerings are more suitable for companies in later stages of development.

There is another disadvantage. If the third party does not participate in the launch of the STO, their responsibility is transferred to the buyer and the seller. The company prepares marketing materials, solicits investors, meets regulatory requirements, and closes the deal. Without professional help, this can become very tedious.

Other limitations of digital public offerings

- The lack of legal protection for crypto assets in some countries.

- Difficulties in asset valuation and record keeping.

- Failure to meet AML/KYC requirements.

- High costs for issuers.

- Paper-based processes in some countries/regions.

Conclusion

Security Token Offerings (STOs) are very popular in 2021, and are the most beneficial case of blockchain technology to date. The combination of blockchain, tokenisation, and digital public offerings creates an optimal environment for a new kind of fundraising.

This system combines the quick and easy fundraising through ICOs with the legal requirements that apply to IPOs.

Security Token Offerings are not ideal, they still have many challenges and seem like a risky adventure. But they are pretty darn effective when done right.

Before launching an STO campaign, familiarise yourself with STO regulations in your country and best practices. We recommend to consider Estonia for your STO campaign as it is a most suitable and convenient jurisdiction for all projects related to digital assets managing.

Contact Us

Specialists from AlphaLAW will be happy to help you with Fintech projects. Our assistance includes the preparation of the list of required documents, help in developing company procedural rules, translation of documents into Estonian/English and support throughout the whole licensing process.

In case you have any questions please contact us through the following communication channels.