Business Registration Number & Company Registration Number For Hong Kong Companies

This article contains the information about Business Registration Number (BRN) and Company Registration Number (CRN) applied to companies registered in Hong Kong jurisdiction.

What is a Business Registration Number (BRN)?

A Business Registration Number (BRN) is a unique number assigned to a business by the Inland Revenue Department (IRD) of Hong Kong upon registration.

It is used as a tax identification number (TIN) for businesses. This means that a BRN is required for all legal business transactions and tax payments in Hong Kong.

Which companies need a BRN?

In brief, all businesses that are required to register with the IRD need a BRN.

According to the Business Registration Ordinance (the BRO), any person doing business in Hong Kong (all exemptions are listed below) must register their business with the IRD’s Business Registration Office within one month of starting business.

Note that registering a business is not the same as registering a company.

Registering a business is about becoming a taxpayer and is administered by the IRD, while the registering a company is about establishing a legal entity and is administered by the Companies Registry. When you incorporate a company in Hong Kong, you need to register with both institutions and it happens simultaneously.

Normally, it is a task of Corporate Secretary to ensure that such procedures are done on time and in accordance with all regulations. According to the rules of Hong Kong, foreign companies present in Hong Kong must register with the IRD if:

- they have a representative or liaison office in Hong Kong;

- they rent out their property located in Hong Kong;

- they have established an office in Hong Kong, even if they do not actually do business in Hong Kong.

Certain business activities exempt from registration, such as farming, gardening, raising and breeding livestock, fishing - but only if you do not fall under the above rules, i.e. you do not have a company or you have a foreign company that does not need to be registered; charity work - but only if you are a recognized charity.

How to get a BRN?

A BRN is allocated to a company by Inland Revenue Department as a result of the registration process. To register, you must submit an application and pay the fee and levy. If your application is successful, you will receive a Business Registration Certificate, which contains a BRN of the company.

Note that failure to register a business or violating other provisions of BRO may result in a fine not exceeding HKD 5,000 and up to 1 year in prison.

The Companies Registry Guide (for limited companies)

The BRN Format

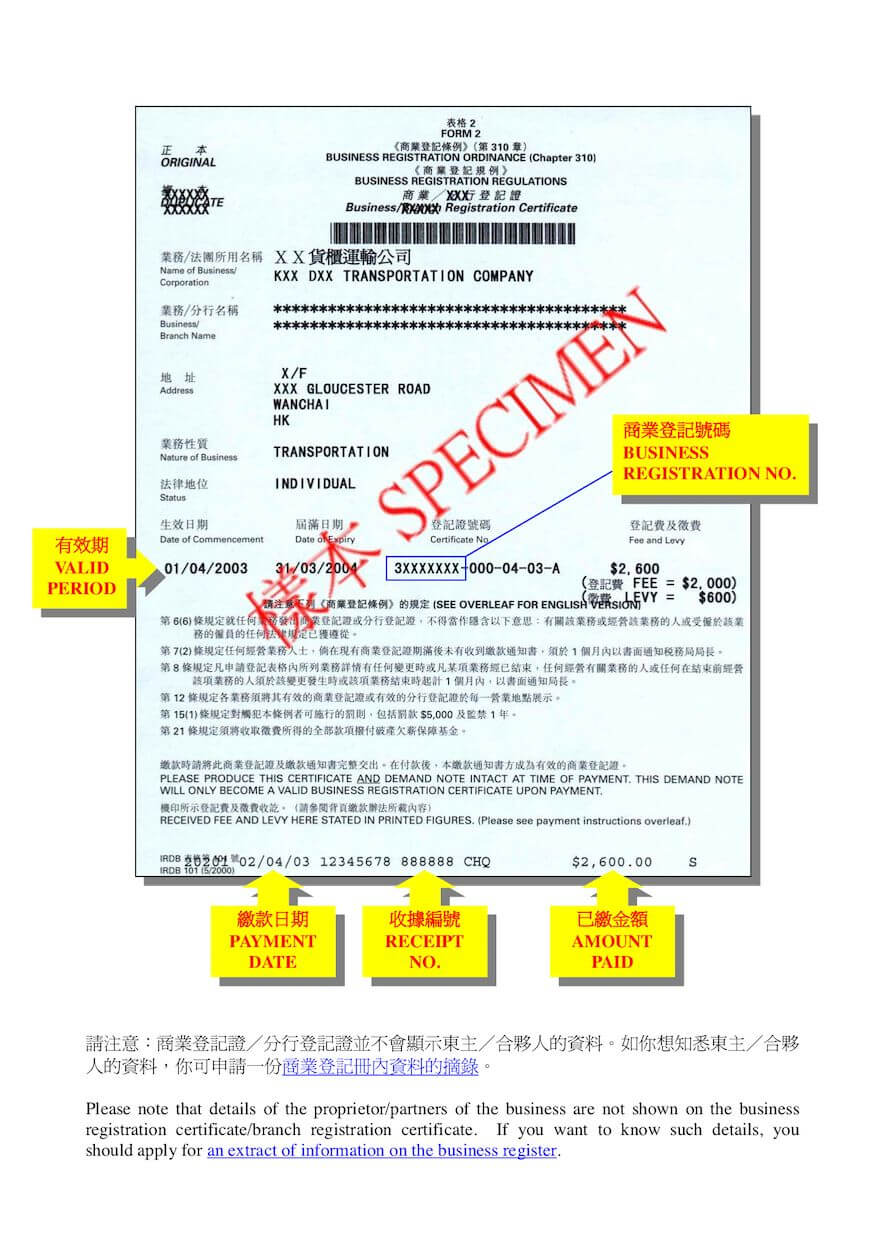

A BRN is the first 8 digits of the ‘Certificate no.’ on the business registration certificate, for example: 99999999-&&&-&&-&&-&. The remaining digits and letters encode information relevant to the IRD.

Let’s look at an example of Business Registration Certificate where you can find a BRN and other information related to business registration:

Where to look up a Business Registration Number

You can check the BRN of any IRD registered business through the eTAX service. To find out a BRN, you need to enter the full Chinese or English name of the company and its location, e.g. Hong Kong, Kowloon or New Territories.

The difference between a Business Registration Number and a Company Registration number

If you want to set up a local limited liability company in Hong Kong or register a company incorporated outside Hong Kong with a place of business in Hong Kong, submit an application to Companies Registry. If the application is successful, you will receive a Business Registration Certificate along with your Certificate of Incorporation.

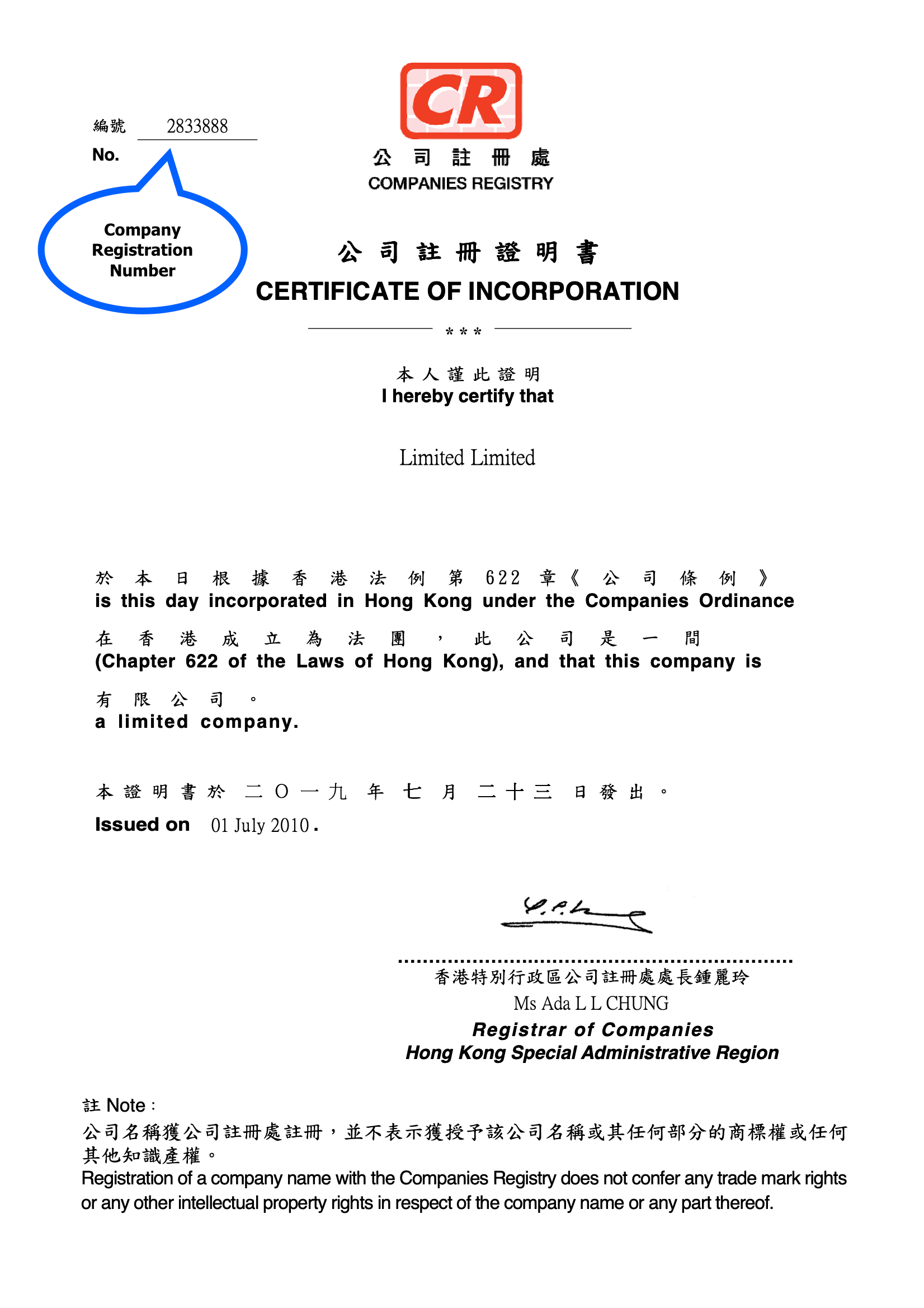

The Certificate of Incorporation contains your Company Registration Number (CRN), which is the 7-digit number in the top left corner.

The certificate looks like this:

Along with the registered name and BRN, the CRN is an important identifier of the company. These identifiers are used whenever you interact with the government or business partners, or sign any legal documents (such as opening a bank account and renting an office).

The main difference between a CRN and a business registration number (BRN) is in their main functions. The CRN can be compared to a company’s social security number. It is used as an official means of representing a business in legal documents and government records. The BRN serves as a tax identification number and is used to identify a business for the purpose of administering the tax laws of the country.